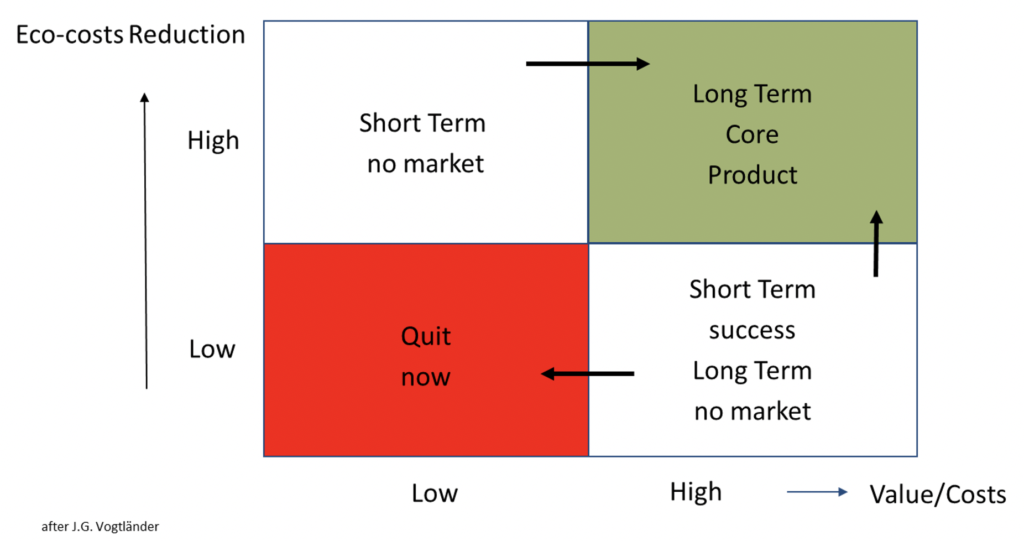

The concept of Eco-costs Reduction, illustrated in the Product Portfolio Strategy Matrix below, can help companies make these decisions and strengthen consumer interest in their product. Companies like Unilever, Volkswagen, DSM and Vattenfall have invested in either changing their product portfolio (i.e. DSM) or increasing the sustainability of existing products through significant Eco-costs Reduction (i.e. Volkswagen, Unilever, Vattenfall). These approaches were intended to avoid either being squeezed (“trapped”) out of existence, illustrated by the matrix’s lower left-hand quarter, or not generating sufficient returns, represented in the upper left-hand quarter.

In the short-term, reducing environmental burden alone is not enough to lift a company to the matrix’s optimal upper right-hand quarter. Going green is certain to incur investment costs, so the company must create supplemental value to off-set deterioration of the Value/Costs ratio. Product innovation requires “eco-efficient value creation”, i.e. high Eco-costs reduction simultaneously combined with higher overall customer value for product. Fulfilling this double objective is key to Successful Circular Business Models.

Although oriented towards clean technology products, for example, start-ups and fast growing SME’s like Tesla and pioneering energy companies have struggled to be profitable in the short term because they lacked economies of scale. The matrix illustrates this in the upper left quarter: “Short Term” (product innovation and introduction period), “no market” (lack of market returns/economies of scale). External boosts like temporary subsidies or governmental regulations (all commercial boats on the Amsterdam canals to be non-fossil fuel by 2025) stimulate green investment, but a sustainable transition from the matrix’s upper-left quarter to the upper-right green “Long Term, Core Product” quarter requires new internal value enhancing proposals to attract customers. New internal value must be created by improving product and/or service quality and image (faster accelerating and less noisy car, a healthy and more enjoyable boat trip on the canals, enhanced convenience through insolation of homes).

For many sectors and products issues on green and value enhancement remain challenging: How can Netherland (NL) continue growing tomatoes when Spanish tomatoes are produced and shipped to NL using green electricity? How can NL’s energy companies transition to “green” be successful when through the import of natural gas over the next 20 years transition period a steadily increasing greenhouse gas footprint will be created? What is the potential of NL generated green and blue hydrogen (currently in the matrix’s upper left quarter) versus hydrogen generation in the Arabian desert through photovoltaic (PV) technology?

Important long-term investment changes are not made overnight. Timing is of crucial importance for a company to exist today, shine in the future and above all to avoid the trap.